How Did The Government Raise Money Before Income Tax

As Congress tackles the burgeoning deficit, among the biggest upcoming debates volition be whether to raise taxes and how. To answer this question, it's important to know: Where does government get its coin from at present?

How does the regime raise money?

When most people remember of "taxes," individual and corporate income taxes are what come to listen. But the government raises about 10% of its revenues from other sources, including "excise" taxes on products such as booze, tobacco and gasoline; customs duties and taxes on imports of foreign goods ("tariffs"); estate taxes; "user" fees for regime services such as issuing a patent or approving a new drug; and gain from the sale of federal property or of rights to cut down trees or explore for oil on federally-owned country.

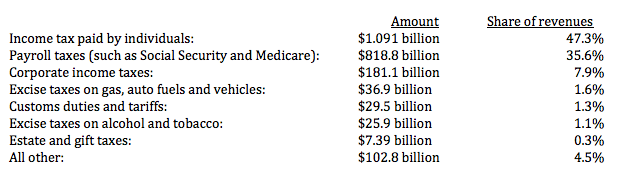

In fiscal 2011, the government raised $2.303 trillion. Hither's where it came from:

A permanent income tax didn't happen until 1913, when the 16th Subpoena was ratified. Even and so, individual income taxes didn't get the biggest source of federal revenues until about 1944. Before then, excise and corporate income taxes provided the bulk of federal funds.

Does the government really need more revenues?

Government is a big part of America's overall economical activity.

On average, authorities spending made up 20.eight% of the nation's annual total economic output (or gross domestic product—"Gdp") from 1970 to 2011. Authorities revenues, on the other hand, have fallen short of those amounts, making upwardly just xviii% of Gross domestic product on average over the same flow. This "fiscal gap" between what authorities spends and what it raises is why we face such sizeable deficits twelvemonth after year and such an astronomically loftier national debt today.

This gap could also worsen because: (1) government is spending more than on Social Security and Medicare to support the growing number of aging Baby Boomers and because of spiraling health care costs; (2) recessions mean lower revenues because companies and people are making less money for government to revenue enhancement; and (3) extending all of the Bush-league-era tax cuts of 2001 and 2003 could crusade the government to forego as much as $3.ane trillion over the next ten years, according to the Pew Fiscal Analysis Initiative.

Cardinal Facts

Other Resources

- Congressional Upkeep Office – The Long Term Outlook for the Federal Upkeep

- Office of Direction and Upkeep – Historical Tables: Receipts by Source

- Internal Revenue Service – Tax Stats at a Glance

- Internal Revenue Service – Information Book

- Urban Establish and Brookings Establishment – Tax Policy Center – Taxation Facts

Source: https://center-forward.org/duis-pharetra-neque-sed-venenatis-euismod-sem-diam-congue-leo-quis-pulvinar-mauris-neque-quis-diam-vestibulum-mattis-eros-et-molestie-maximus/

Posted by: elledgewiturver1996.blogspot.com

0 Response to "How Did The Government Raise Money Before Income Tax"

Post a Comment